اتفاقية إعادة شراء

| المالية |

|---|

|

اتفاقية إعادة الشراء repurchase agreement، أو ريپو repo، هو أحد أشكال الاقتراض قصير الأجل، وخاصة في السندات الحكومية. يبيع الوكيل السندات الأساسية للمستثمرين ويشتريها مرة أخرى بعد فترة وجيزة، عادة في اليوم التالي، بسعر أعلى قليلاً. The difference in the prices and the time interval between sale and repurchase creates an effective interest rate on the loan. The mirror transaction, a "reverse repurchase agreement," is a form of secured contracted lending in which a party buys a security along with a concurrent commitment to sell the security back in the future at a specified time and price. Because this form of funding is often used by dealers, the convention is to reference the dealer's position in a transaction with a counterparty. Central banks also use repo and reverse repo transactions to manage banking system reserves. When the Federal Reserve borrows funds to drain reserves, it can do so by selling a government security from its inventory with a commitment to buy it back in the future; it calls the transaction a reverse repo because the dealer counterparty to the Fed is lending money. Similarly, when the Federal Reserve wishes to add to banking reserves, it can buy a government security with a forward commitment to sell it back. It calls this transaction a repo because the Fed counterparty is borrowing money.[1]

The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets.[2][3]

In 2007–2008, a run on the repo market, in which funding for investment banks was either unavailable or at very high interest rates, was a key aspect of the subprime mortgage crisis that led to the Great Recession.[4] During September 2019, the U.S. Federal Reserve intervened in the role of investor to provide funds in the repo markets, when overnight lending rates jumped due to a series of technical factors that had limited the supply of funds available.[2][5][3]

الهيكلية

Repo facility

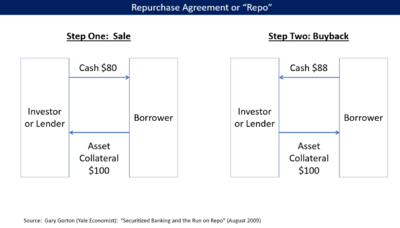

In a repo, the investor/lender provides cash to a borrower, with the loan secured by the collateral of the borrower, typically bonds. In the event the borrower defaults, the investor/lender gets the collateral. Investors are typically financial entities such as money market mutual funds, while borrowers are non-depository financial institutions such as investment banks and hedge funds. The investor/lender charges interest (the repo rate), which together with the principal is repaid on repurchase of the security as agreed.

A repo is economically similar to a secured loan, with the buyer (effectively the lender or investor) receiving securities for collateral to protect himself against default by the seller. The party who initially sells the securities is effectively the borrower. Many types of institutional investors engage in repo transactions, including mutual funds and hedge funds.[6]

Although the transaction is similar to a loan, and its economic effect is similar to a loan, the terminology differs from that applying to loans: the seller legally repurchases the securities from the buyer at the end of the loan term. However, a key aspect of repos is that they are legally recognised as a single transaction (important in the event of counterparty insolvency) and not as a disposal and a repurchase for tax purposes. By structuring the transaction as a sale, a repo provides significant protections to lenders from the normal operation of U.S. bankruptcy laws, such as the automatic stay and avoidance provisions.

Collateral

Almost any security may be employed in a repo, though highly liquid securities are preferred as they are more easily disposed of in the event of a default and, more importantly, they can be easily obtained in the open market if the buyer has created a short position in the repo security by a reverse repo and market sale; by the same token, non liquid securities are discouraged.

Treasury or Government bills, corporate and Treasury/Government bonds, and stocks may all be used as "collateral" in a repo transaction. Unlike a secured loan, however, legal title to the securities passes from the seller to the buyer. Coupons (interest payable to the owner of the securities) falling due while the repo buyer owns the securities are, in fact, usually passed directly onto the repo seller. This might seem counter-intuitive, as the legal ownership of the collateral rests with the buyer during the repo agreement. The agreement might instead provide that the buyer receives the coupon, with the cash payable on repurchase being adjusted to compensate, though this is more typical of sell/buybacks.

Overcollateralization (haircut)

Further, the investor/lender may demand collateral of greater value than the amount that they lend. This difference is the "haircut." These concepts are illustrated in the diagram and in the equations section. When investors perceive greater risks, they may charge higher repo rates and demand greater haircuts.

Reverse repo facility

Whereas a repo facility is a security-buying party acting as a lender of cash to security sellers who effectively borrow cash at interest (the repo rate), with the security they sell serving as collateral, a reverse repo facility is a security-selling party allowing buyers with cash to effectively lend it to the facility at interest with the security they purchase serving as collateral. An example is a bank with cash deposits who loans it to a reverse repo facility to earn interest on it and contribute to their own collateral requirements (as deposit banks) with the collateral they obtain in the transaction.[7]

الاتفاق ثلاثي الأطراف

In a tri-party repo, a third party facilitates elements of the transaction, typically custody, escrow, monitoring, and other services.[4]

الهيكلية والمصطلحات الأخرى and other terminology

The following table summarizes the terminology:

| Repo | Reverse repo | |

|---|---|---|

| Participant | Borrower Seller Cash receiver |

Lender Buyer Cash provider |

| Near leg | Sells securities | Buys securities |

| Far leg | Buys securities | Sells securities |

التاريخ

In the United States, repos have been used from as early as 1917 when wartime taxes made older forms of lending less attractive. At first, repos were used just by the Federal Reserve to lend to other banks, but the practice soon spread to other market participants. The use of repos expanded in the 1920s, fell away through the Great Depression and WWII, then expanded once again in the 1950s, enjoying rapid growth in the 1970s and 1980s in part due to computer technology.[8]

According to Yale economist Gary Gorton, repo evolved to provide large non-depository financial institutions with a method of secured lending analogous to the depository insurance provided by the government in traditional banking, with the collateral acting as the guarantee for the investor.[4]

In 1982, the failure of Drysdale Government Securities led to a loss of $285 million for Chase Manhattan Bank. This resulted in a change in how accrued interest is used in calculating the value of the repo securities. In the same year, the failure of Lombard-Wall, Inc. resulted in a change in the federal bankruptcy laws pertaining to repos.[9][10] The failure of ESM Government Securities in 1985 led to the closing of Home State Savings Bank in Ohio and a run on other banks insured by the private-insurance Ohio Deposit Guarantee Fund. The failure of these and other firms led to the enactment of the Government Securities Act of 1986.[11]

In 2007–2008, a run on the repo market, in which funding for investment banks was either unavailable or at very high interest rates, was a key aspect of the subprime mortgage crisis that led to the Great Recession.[4]

In July 2011, concerns arose among bankers and the financial press that if the 2011 U.S. debt ceiling crisis led to a default, it could cause considerable disruption to the repo market. This was because treasuries are the most commonly used collateral in the US repo market, and as a default would have downgraded the value of treasuries, it could have resulted in repo borrowers having to post far more collateral. [12]

During September 2019, the U.S. Federal Reserve intervened in the role of investor to provide funds in the repo markets, when overnight lending rates jumped due to a series of technical factors that had limited the supply of funds available.[2]

حجم السوق

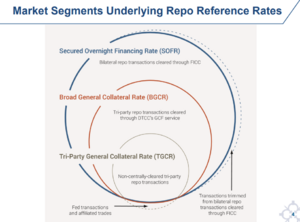

The New York Times reported in September 2019 that an estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets.[2] The Federal Reserve Bank of New York reports daily repo collateral volume for different types of repo arrangements. As of 24 October 2019, volumes were: secured overnight financing rate (SOFR) $1,086 billion; broad general collateral rate (BGCR) $453 billion, and tri-party general collateral rate (TGCR) $425 billion.[3] These figures however, are not additive, as the latter 2 are merely components of the former, SOFR.[13]

The Federal Reserve and the European Repo and Collateral Council (a body of the International Capital Market Association) have tried to estimate the size of their respective repo markets. At the end of 2004, the US repo market reached US$5 trillion. Especially in the US and to a lesser degree in Europe, the repo market contracted in 2008 as a result of the 2008 financial crisis. But, by mid-2010, the market had largely recovered and, at least in Europe, had grown to exceed its pre-crisis peak.[14]

الريپو كمعادلة رياضية

اتفاقية إعادة الشراء، أو ريپو، أو اتفاقية البيع والشراء، هي معاملة مالية تتم في تاريخ الصفقة tD بين الطرف A والطرف B:

- (i) A سيقوم في التاريخ القريب ببيع سند معين S حسب السعر المتفق عليه PN إلى الطرف B

- (ii) A سيقوم في التاريخ البعيد tF (بعد tN) بإعادة شراء السند S من الطرف B بالسعر PF الذي تم الاتفاق عليه مسبقاً في تاريخ الصفقة.

إذا تم افتراض أسعار فائدة إيجابية، فمن المتوقع أن يكون سعر إعادة الشراء PF أكبر من سعر البيع الأصلي PN.

الفرق بين السعرين (معدلة حسب الوقت) يطلق عليها معدل الريپو، وهو معدل الفائدة السنوي للمعاملة. يمكن تفسيره على أنه سعر الفائدة للفترة بين "التاريخ القريب" و"التاريخ البعيد".

الغموض في استخدام مصطلح ريپو

أثار مصطلح ريپو الكثير من الالتباس: هناك نوعين من المعاملة التي

البنية والمصطلحات الأخرى

يلخص الجدول التالي المصطلح:

| ريپو | ريپو معكوس | |

|---|---|---|

| المشارك | المقترض البائع مستقبل النقود |

المقرض البائع مقدم النقود |

| Near leg | بيع السندات | شراء السندات |

| Far leg | شراء السندات | بيع السندات |

آجال استحقاق الريپو

أنواع الريپو

الاستخدامات

بالنسبة للبائع، يعتبر الريپو فرصة للاستثمار النقدي لفترة زمنية حسب الاتفاق (عادة ما تكون الاستثمارات الأخرى محدودة الفترة). وهي استثمارات مضمونة قصيرة الأجل وأكثر أمناً نظراً لأن المستثمر يحصل على ضمانات. السيولة السوقية للريپو جيدة، وأسعار صرفه تنافسية للمستثمرين. الصناديق النقدية هي مجموعة ضخمة من مشتري اتفاقيات الشراء.

بالسنبة للمتداولين في شركات التداول، يستخدم الريپو لتمويل مواقف مالية طويلة الأجل، الحصول على تكاليف تمويل أرخص للاستثمارات المضاربة الأخرى، وتغطية المراكز الماليةالقصيرة في السندات.

استخدام الاحتياط الفدرالي الأمريكي للريپو

استخدام بنوك الاحتياط الهندية للريپو

المخاطر

انظر أيضاً

- Collateral management

- مقايضة عملات

- Discount window

- Dollar roll

- الصناديق الفدرالية

- Implied repo rate

- Margin (finance)

- سوق الأموال

- المعدل البنكي الرسمي

- Total return swap

المصادر

- ^ [see https://www.newyorkfed.org/markets/domestic-market-operations/monetary-policy-implementation/repo-reverse-repo-agreements]

- ^ أ ب ت ث Matt Phillips (18 September 2019). "Wall Street is Buzzing About Repo Rates". The New York Times.

- ^ أ ب ت "Treasury Repo Reference Rates". Federal Reserve. Retrieved 26 October 2019.

- ^ أ ب ت ث ج Gary Gorton (August 2009). "Securitized banking and the run on repo". NBER. doi:10.3386/w15223. S2CID 198184332. Retrieved 26 October 2019.

- ^ "Statement Regarding Monetary Policy Implementation". Federal Reserve. 11 October 2019.

- ^ Lemke, Lins, Hoenig & Rube, Hedge Funds and Other Private Funds: Regulation and Compliance, §6:38 (Thomson West, 2016 ed.)

- ^ Chen, James (28 December 2020). "Reverse Repurchase Agreement". STOCK TRADING STOCK TRADING STRATEGY & EDUCATION. Investopedia. Retrieved 16 March 2021.

- ^ خطأ استشهاد: وسم

<ref>غير صحيح؛ لا نص تم توفيره للمراجع المسماةNYconv - ^ Wall St. Securities Firm Files For Bankruptcy New York Times 13 August 1982 [1]

- ^ The Evolution of Repo Contracting Conventions in the 1980s FRBNY Economic Policy Review; May 2006 [2]

- ^ "The Government Securities Market: In the Wake of ESM Santa Clara Law Review January 1, 1987".

- ^ Darrell Duffie and Anil K Kashyap (27 July 2011). "US default would spell turmoil for the repo market". Financial Times. Archived from the original on 10 December 2022. Retrieved 29 July 2011.

- ^ Sherman, Scott (26 June 2019). "Reference Rate Production Update ARRC Meeting" (PDF). Federal Reserve Bank of New York. Retrieved 21 November 2019.

- ^ خطأ استشهاد: وسم

<ref>غير صحيح؛ لا نص تم توفيره للمراجع المسماةGillian

وصلات خارجية

- Baklanova, Viktoria; Copeland, Adam; McCaughrin, Rebecca (September 2015) (PDF), Reference Guide to U.S. Repo and Securities Lending Markets, Federal Reserve Bank of New York, http://www.newyorkfed.org/research/staff_reports/sr740.pdf

- Repurchase and Reverse Repurchase Transactions – Fedpoints – Federal Reserve Bank of New York

- Explanation of the Federal Reserve repurchase agreements actions of August 10, 2007

- Statement Regarding Counterparties for Reverse Repurchase Agreements March 8, 2010